█ Record quarterly revenue and sustained operating profit thanks to customer diversification strategy and increased sales volume in North America in the second quarter

█ Increased sales of ESS and hybrid-oriented copper foil in the second half of the year, and industry's first HVLP4-grade product for AI accelerators is expected to be supplied in full-scale from next year upon completion of quality tests with North American end customers

█ Despite market uncertainties, we will increase corporate value by securing high-end market leadership through customer-centered activities, technology leadership, global base strategy, and development of high-value-added products,' said CEO Kim Yeon-seop.

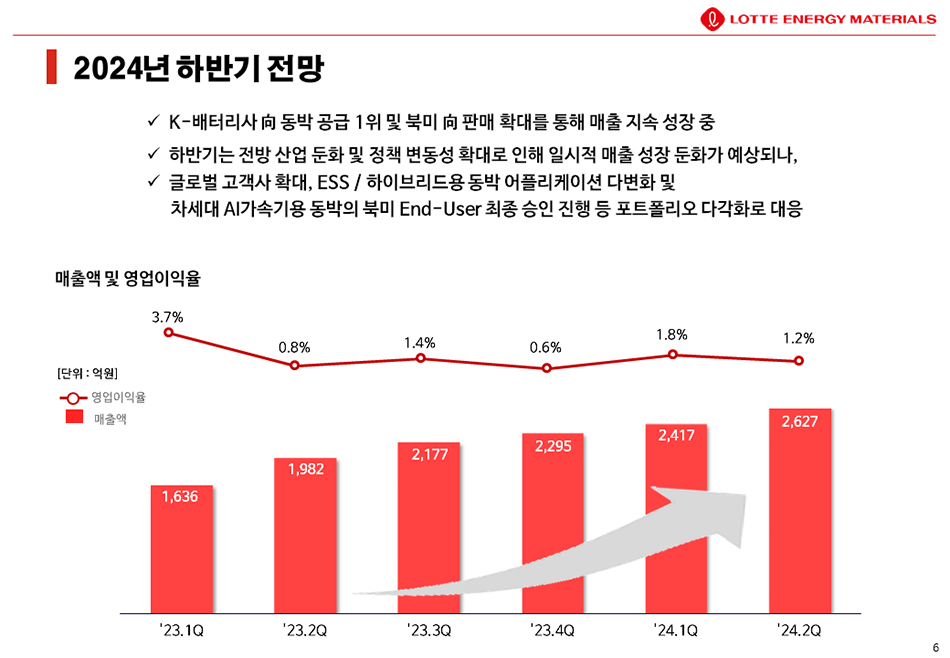

LOTTE Energy Materials (CEO Yeon-seop Kim) realized its fifth consecutive quarter of sales growth, posting the highest quarterly sales in the second quarter following the first quarter.

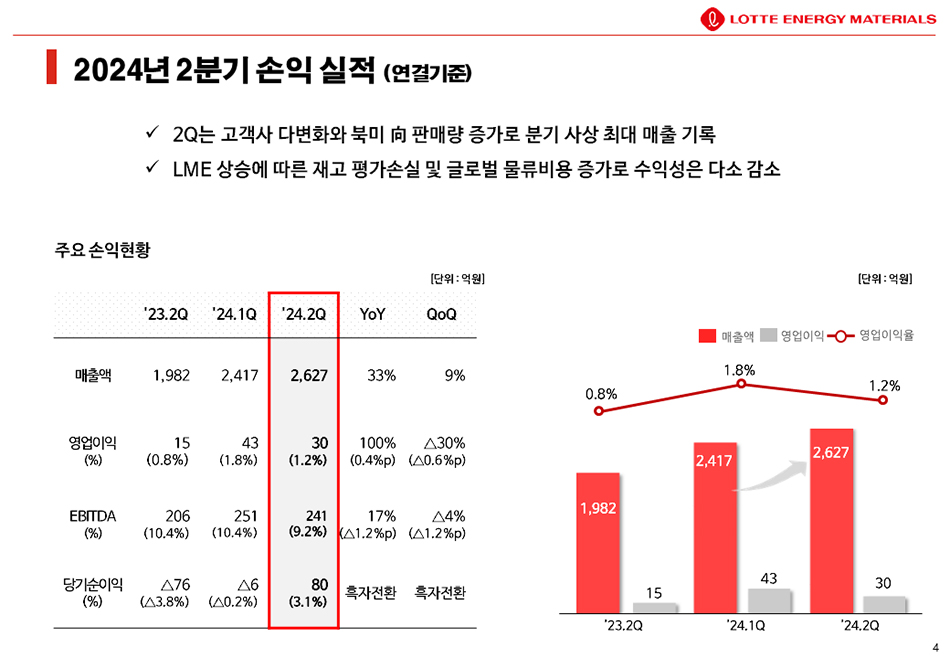

LOTTE Energy Materials announced on June 6 its preliminary results for the second quarter of 2024 (consolidated basis), reporting sales of KRW 262.7 billion and operating profit of KRW 3 billion. Sales increased 33% and operating profit (KRW 1.5 billion) increased 100% compared to the same period last year (KRW 198.2 billion). Net profit also turned positive at 8 billion won.

In the second quarter, as in the first quarter, diversification of customers and increased sales to North America contributed to the record quarterly sales. In particular, North American sales grew significantly, up 243% year-on-year. Sales of copper foil for hybrid applications in Japan were also strong, and the company expects sales of this product to grow more than 40% year-to-date.

In addition, Q2 sales grew 9% compared to the previous quarter's sales (KRW 241.7 billion), and operating profit (KRW 4.3 billion) declined 30% due to the effect of inventory valuation and increased global logistics costs due to the rise in international copper prices, but the company remained the only company in the copper foil industry with a profit. While the debt-to-equity ratio increased slightly to 31.2% from the previous quarter, the company still maintains the highest financial stability and net cash position in the industry and has the capex capacity to drive its next-generation battery business.

As for the second half of the year, we expect a temporary slowdown in sales growth due to weakness in all industries and policy volatility such as the U.S. presidential election, we will focus on securing global customers and diversify our product portfolio by developing high-value-added products such as ESS, hybrid, and AI semiconductors as well as copper foil for electric vehicles.

First, new overseas plants will be built in line with global customers' new plant expansion schedules. As the North American and European markets are still expected to be high-growth regions, we will minimize external variables and proceed with investment flexibly in consideration of global policy volatility. In particular, when large-scale capital is invested, we will accelerate the process after carefully analyzing the profitability and economics of the project.

In addition, the supply of the industry's first AI accelerator-focused HVLP4 (Hyper Very Low Profile) next-generation 'ultra-low profile' product is being visualized. Currently, the network copper foil used in the market for AI accelerators is HVLP3 generation or lower.

LOTTE Energy Materials, the No. 1 circuit board M/S company in Korea, passed the quality test of next-generation HVLP4-class products with a domestic customer in the first half of this year, and expects that its products will be supplied to next-generation AI accelerators in earnest from next year if it passes the quality test of North American end customers in the second half of this year.

Finally, the production of next-generation battery materials is also nearing completion. A 70-ton-per-year sulfide solid electrolyte pilot line will be completed this month. Compared to other companies, it has high technical competitiveness in terms of water stability and ionic conductivity, and has received excellent reviews from customers. For LFP cathode active materials, a pilot line with a capacity of 1,000 tons per year is scheduled to be completed in October.

'Although there is uncertainty in the current market, we will increase our corporate value by securing high-end market leadership through customer-centered activities, leading technology, continuing to promote our global base strategy, and developing high-value-added products,' said Kim Yeon-seop, CEO of LOTTE Energy Materials.